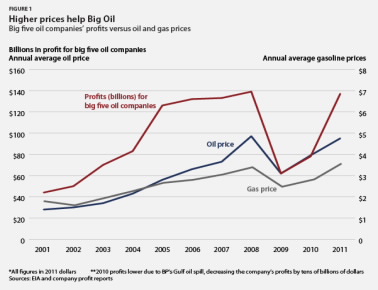

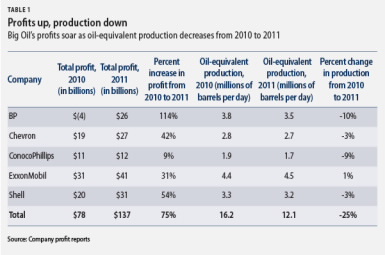

Washington, D.C.–(ENEWSPF)–February 7, 2012. Today BP posted net earnings of $23.9 billion, bringing the total profits for the five largest oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shell—to a record-high $137 billion in profits in 2011. Despite their increased profit margins—up 75 percent from 2010—the Center for American Progress column released today, “Big Oil’s Banner Year,” found that they maintain their taxpayer subsidies while yielding lower oil production than in 2010 and raising prices for consumers at the pump.

Here are some more highlights from the big five’s activities in 2011:

- They produced 25 percent less oil and “oil equivalent” in 2011 compared to 2010.

- They spent a total of $38 billion, or 28 percent, of their profits to repurchase their own stock.

- They are sitting on more than $58 billion in cash reserves as of the end of 2011.

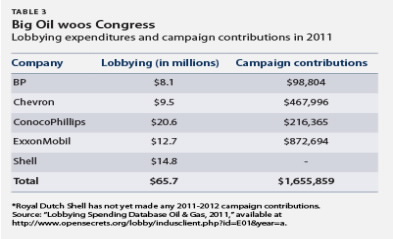

- They spent $1.6 million on campaign contributions and $65.7 million on lobbying efforts.

- For every $1 spent on lobbying in Washington, the big five received $30 worth of tax breaks, an amount equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

In spite of these high profits and oil prices, oil-equivalent production fell from 2010 levels for all five companies. ExxonMobil’s profit, for example, increased by 31 percent from 2010 to 2011 while its oil and natural gas production decreased by 5 percent during the same time period. Instead of using their additional earnings to increase production or investment in alternative fuels, they used $38 billion, or 28 percent of annual net income, to repurchase their own stocks and invested in politicians to maintain the policies that led to their enormous profits over the past decade.

These companies also cling to tax breaks while maintaining $58 billion in cash reserves. This is nearly 30 times more than the estimated $2 billion in annual special tax breaks that these companies receive. ExxonMobil, the most profitable of the big five, paid an effective tax rate of 17.6 percent (from 2008–2010 data), which is 3 percent less than what the average American family paid. But Exxon and other oil companies that receive these tax breaks do not pass benefits on to consumers. Last year the big five spent $65.7 million on lobbying efforts, successfully persuading their congressional friends to retain tax breaks. Both the House and Senate had votes to scale back these tax breaks, and both proposals were defeated.

Last year, the Democrats on the House Natural Resources Committee released “Profits and Pink Slips: How Big Oil and Gas Companies are Not Creating U.S. Jobs or Paying Their Fair Share.” This report revealed “Despite generating $546 billion in profits between 2005 and 2010, ExxonMobil, Chevron, Shell, and BP combined to reduce their U.S. workforce by 11,200 employees over that time.” More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees. But that doesn’t even include their undisclosed contributions to the U.S. Chamber of Commerce, the American Petroleum Institute, or other organizations that also support tax breaks for Big Oil.

Seventy-four percent of Americans agree with the president’s desire to eliminate tax breaks for the oil and gas industry. Ending the $2 billion in annual tax breaks for the big five oil companies could pay for:

- The salaries of 36,000 high school teachers earning an average of $55,000 per year

- Pell Grants for more than 500,000 aspiring college students

- Sixty-seven thousand home solar energy systems costing an average of $15,000, which would reduce carbon dioxide pollution by 175,000 metric tons annually

After a year of near-record profits and a decade of more than $1 trillion in total profits, the least the five huge oil companies can do to help our nation is to relinquish their unnecessary and ineffective tax breaks.

To read the full column, click here.

Download full data on Big Oil’s profits and activities in 2011 (.xls)

Source: americanprogress.org