Washington, D.C.–(ENEWSPF)–August 12, 2011. The recent debt deal struck last week resulted in congressional Republicans stating that tax increases cannot be part of deficit reduction. Michael Ettlinger, Vice President for Economic Policy at the Center for American Progress, explains why these Republicans are drawing such hard lines in his piece entitled, “The Deficit –Busting Pay Freeze We Need: Ending the Bush Bonus Tax Cuts Requires Little Sacrifice, Does No Harm.”

The most vigorously debated tax proposal during the Obama presidency has been the one the president has pushed since his election campaign—permanently extending the portion of the Bush tax cuts that reduces the taxes of all taxpayers, including the rich, but allowing the tax breaks that only apply to the better-off to expire.

To hear opponents speak of this proposal, one would think that the fight over these tax breaks for the wealthiest is an epic struggle over whether to veer the country onto a path to socialism or continue to allow the successful the fruits of their success. Well, it isn’t.

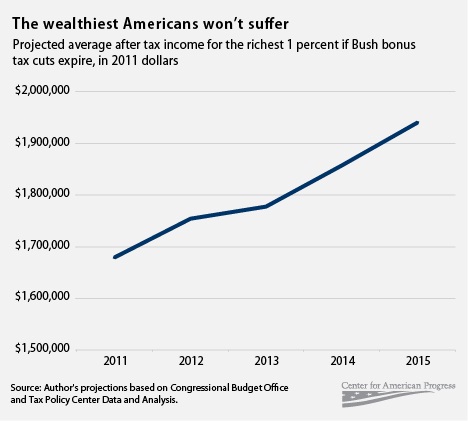

In fact, assuming the income of the wealthy continues to rise at the same rate it has over recent decades, allowing the Bush bonus tax cuts to expire basically would result in a mere 10-month pay freeze for the richest 1 percent—after which their income is back where it started and the rapid rise of the income of the wealthy will still be on track. As figure 1 shows, if the tax cuts were allowed to expire at the end of 2012, as currently scheduled, the effect on annual income for the top 1 percent would be a dip in the rate of increase for 2013—and that’s it. Their after-tax income for all of 2013 would still be higher than for 2012 even adjusted for inflation. And it would continue to grow.

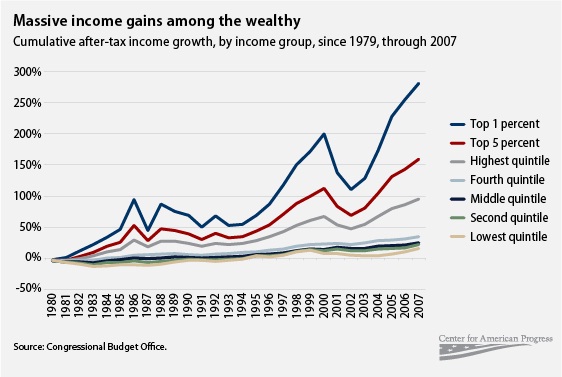

The wealthy can afford a 10-month pay freeze. In the 25 years from 1982 to 2007, the most recent year for which reliable data are available, the before-tax, inflation-adjusted income of the richest 1 percent more than tripled. Just between 2001 and 2007, this same group’s before-tax income went up by more than 50 percent. Their after-tax income went up even faster—as should be expected with the tax cuts they have benefited from. (see Figure 2)

Compare the pay freeze for millionaires that letting the Bush bonus tax cuts expire would create to the decade-long (and counting) pay freeze suffered by the middle class. It hardly seems like a great imposition to ask the wealthy to pay a bit more as part of achieving vitally needed deficit reduction. Nor is such a temporary glitch in their meteoric income rise likely to devastate the economy. Taxing the wealthy at higher rates is certainly not the entire answer to our deficit problems but letting the Bush bonus tax cuts expire should be part of any deficit reduction plan.

Michael Ettlinger is Vice President for Economic Policy at the Center for American Progress.

To read this column online, click here.

Source: americanprogress.org