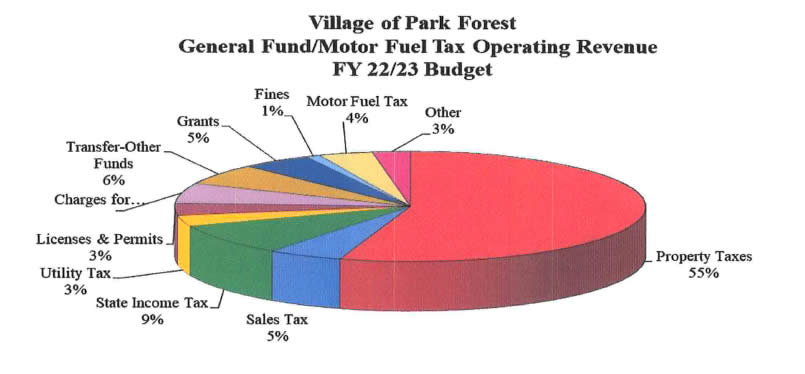

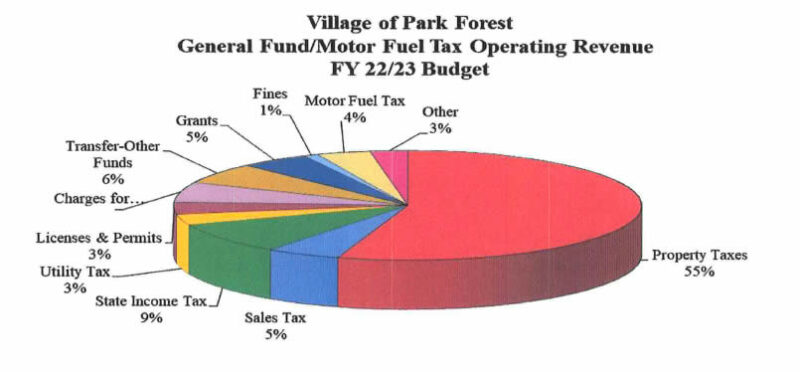

Park Forest, IL-(ENEWSPF)- Village of Park Forest Finance Director Mark Pries anticipates a 0% tax levy increase for the next fiscal year. Revenues for fiscal year 2022 are currently over-budget. After all the numbers have been crunched, that means no increase to the levy in the General Corporate portion of the 2023 fiscal year levy. An estimated tax levy is on the agenda for Monday’s meeting of the Board of Trustees.

Director Pries told the Village Board at a Saturday meeting in November that the overall actual revenue is at 104% of budget, “We are over budget in a number of areas, including sales & use tax, utility tax, state income tax, and real estate transfer tax, to name a few,” the minutes from that meeting say. That has left the Village with almost 6 months fund balance in reserve. The goal is to have half that amount as payments from the state of Illinois for sales tax and other revenues often lag.

“The current fiscal year has a $2.9 million surplus,” Director Pries told the board in November, “which is not typical and mentioned this is the second year there is a surplus of over $2 million. The Board’s Fiscal Policies call for a minimum operating reserve of three months, however, we are in excess of that with the adjusted fund balance at 5.97 months.”

“Director Pries said fiscal year 2022 saw benefits of two years of income taxes because the tax filing deadline was delayed until July 2022,” according to the minutes from that meeting. “Sales and Use Tax collections are 2.8% higher this year compared to this same time period last year and Utility Tax is also up 1.9%. IMRF rates are scheduled to decrease from 9.6% to 6.69% in 2023. Cook County EAV has decreased 15% while Will County EAV increased 19%.”

The second installment of Cook County property tax bills is expected to be mailed soon. The Cook County Board of Commissioners approved a balanced $8.8 billion FY2023 budget on November 17, which includes millions in funding for equity programs and pandemic relief without increasing taxes or cutting essential services. That budget passed unanimously, 16-0.

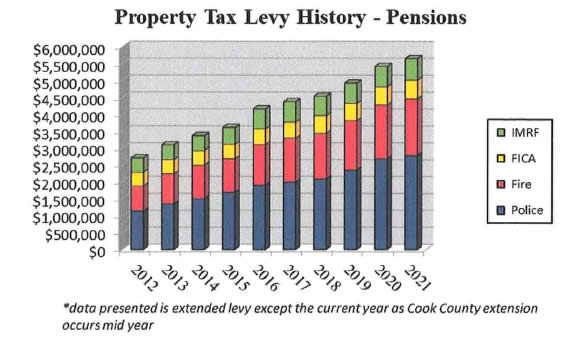

The Park Forest tax levy consists of six categories, and each one is evaluated separately. Police and Fire personnel make up 71% of the total salaries. Police have 42 sworn personnel, one whose salary is reimbursed by the state, and Fire have 24 sworn personnel, according to Village sources.

In recent years, a higher share of the levy funds Police and Fire pensions, with IMRF and Social Security receiving property tax revenue.

“By law, the Village must adopt an estimated tax levy no less than 20 days before the adoption of the tax levy,” according to an October 2022 memo by Director Pries. “Therefore, an estimated tax levy resolution will be on the November 21 meeting agenda for adoption.”

Adopting an estimated tax levy resolution is done each year and does not levy any taxes; only the tax levy ordinance adopted in December actually levies a tax, Director Pries stressed in the October memo.

First reading of the actual tax levy ordinance is scheduled for November 28, 2022, Director Pries said.